If you have adequate cash to cover a high insurance deductible in case of a claim, you need to perform. This assists maintain your yearly premium reduced and also may possibly conserve you a whole lot of money in the future, particularly if you do not need to sue.

This is due to the fact that the worth of your car might be around what you 'd have to pay out of pocket in case of a case, making a high deductible price expensive (cheaper). You can generally select from a variety of insurance deductible quantities. There are also some car insurance plan without any deductible, but they're so expensive that they're commonly not worth it.

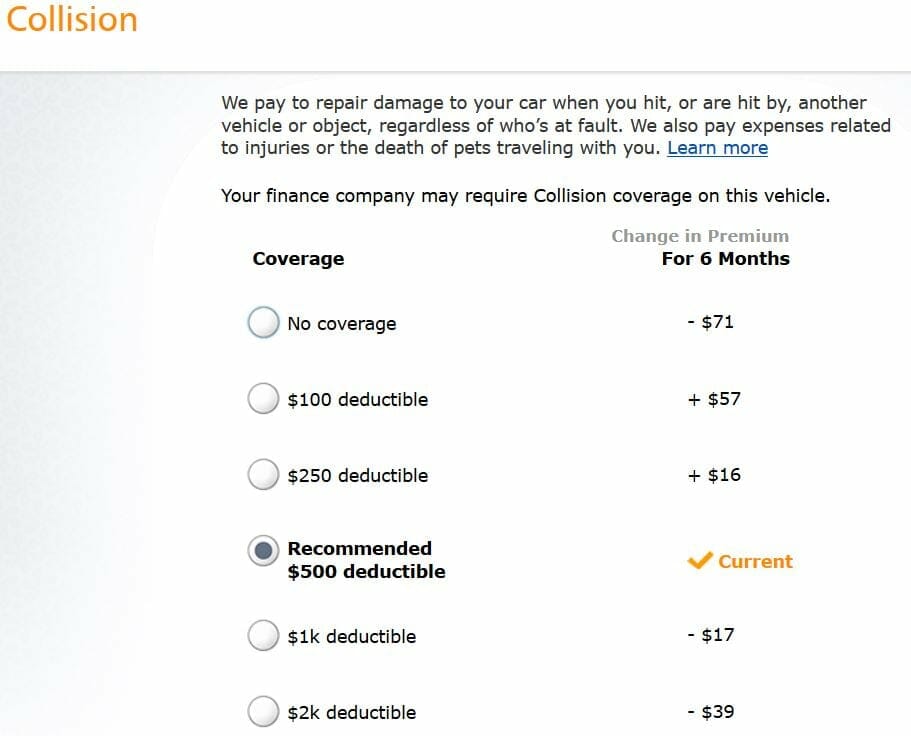

Our very own study shows that there isn't a substantial result on your costs once you transcend a $750 deductible, so take into consideration maintaining your insurance deductible amount in between $500 as well as $1,000 (suvs). It ought to be noted that if you finance or rent your automobile, you might not have a choice in the deductible on your car insurance plan.

risks auto cars vehicle

risks auto cars vehicle

LLC has made every effort to make certain that the info on this site is correct, yet we can not guarantee that it is cost-free of mistakes, errors, or noninclusions - cheap car insurance. All web content and also solutions provided on or with this site are supplied "as is" and also "as available" for use.

See This Report about Which Car Insurance Deductible Is Right For You? - The Zebra

When it comes to automobile insurance policy, a deductible is the amount you would certainly have to pay of pocket after a protected loss before your insurance policy coverage kicks in. Vehicle insurance policy deductibles function in different ways than clinical insurance deductibles with car insurance policy, not all sorts of coverage need a deductible. auto. Obligation insurance coverage doesn't need a deductible, yet comprehensive and crash protection usually do.

laws cheap car prices perks

laws cheap car prices perks

When you're adding that coverage to your car insurance coverage policy, you'll typically have the chance to make a decision where you intend to establish the insurance deductible. Normally, the higher you set your insurance deductible, the reduced your monthly insurance policy premiums will certainly be but you do not desire to establish it so high that you wouldn't have the ability to actually pay that amount if needed.

What does a vehicle insurance policy deductible mean? If you backed your vehicle right into a telephone pole, your accident insurance policy would pay for the cost of the damages.

If the total expense of repair work comes to $1800, your insurance will only spend for $1300. You can locate your insurance deductible amounts is noted on your statements page. Having to pay an insurance deductible means you can do a type of cost-benefit analysis prior to you make a case with your insurance firm.

What Does Deductible Mean In Car Insurance? for Dummies

We don't sell your info to 3rd parties. What type of protection calls for an insurance deductible? Not all sorts of auto insurance protection require an insurance deductible. Responsibility insurance policy, which covers the prices if you damage a person's home or wound a person with your car, never ever calls for a deductible - suvs. Responsibility coverage is the foundation of many automobile insurance coverage policies, as well as in a lot of states in the U.S., you're needed by law to have it.

automobile car perks insure

automobile car perks insure

Accident insurance policy covers damage to your automobile from a crash, no matter who was at fault. cheaper car. Both crash and also compensation coverage normally call for that you pay an out-of-pocket deductible but you select the amount, and where you establish your insurance deductible will have an affect on your month-to-month insurance coverage costs. Just how do I determine what my deductible should be? Normally, the greater you establish your insurance deductible, the lower your regular monthly premiums.

The opposite is additionally real, choosing a reduced insurance deductible means you'll have to pay a greater costs., yet keep in mind, there's an extremely real opportunity you'll have to pay that insurance deductible one day.

Should you attempt to conserve money by selecting a greater deductible or really feel even more safe and secure by going with a lower one? To choose the ideal deductible for you, you'll require to consider your driving history, your emergency situation fund, and also the prices of different deductibles, along with numerous various other elements.

How $500 Or $1000 Auto Insurance Deductible? - Policy Advice can Save You Time, Stress, and Money.

Key Takeaways Your insurance deductible is the portion of prices you'll pay for a covered claim. Evaluate your vehicle's value, your reserve, as well as the costs of coverage when selecting a deductible. Picking a greater deductible might assist you save cash on costs, but this means you'll have to pay even more out of pocket after a crash (trucks).

In some states, you might additionally have a deductible for:: Pays to repair your cars and truck after damage triggered by a motorist without insurance policy or without enough coverage.: Pays your medical bills when you've been injured in an accident - auto.: Covers the expenses of some mechanical repair services, just like a service warranty.

Whether you pay an insurance deductible after an event relies on your protection, who is at fault, your insurer, and also your state's laws. For instance, in California, you might certify for an insurance deductible waiver on your crash coverage, which indicates your insurance company will certainly pay the insurance deductible if a without insurance driver hits you. cheaper.

Exactly how Does an Insurance deductible Work? Visualize a tree branch drops on your car and causes damage. You sue on your extensive coverage as well as the repair store estimates it will certainly set you back $1,000 to repair. What you'll pay relies on your deductible: $250 $250 $750 $500 $500 $500 $1,000 $1,000 $0 If the expense of fixing the damage coincides or almost the like your insurance deductible, you may choose not to sue considering that you 'd lose any kind of claim-free discount. cheap car insurance.

3 Simple Techniques For Car Insurance Deductibles & How They Work

When Do You Pay a Deductible? You'll usually pay your deductible straight to the auto repair service shop after they complete the repair work. The insurance provider will certainly deduct your part from the total amount they send out to the service center. In the scenario above, with a $500 deductible, the insurance policy firm would pay the automobile fixing store $500, and you would certainly be anticipated to pay the other $500 - credit.

When you get cars and truck insurance policy, you'll need to make numerous selections regarding your insurer and also optional insurance coverages (automobile). You'll likewise need to pick your insurance deductible, which can be much more challenging than it seems. Should you attempt to save money by picking a higher insurance deductible or really feel more safe by opting for a reduced one? To select the ideal insurance deductible for you, you'll need to consider your driving history, your emergency fund, as well as the prices of different deductibles, in addition to numerous various other variables.

Secret Takeaways Your deductible is the part of costs you'll pay for a covered insurance claim. Consider your vehicle's value, your reserve, as well as the expenses of coverage when selecting a deductible. Selecting a higher insurance deductible may help you save cash on costs, but this means you'll have to pay even more expense after an accident (business insurance).

In some states, you might additionally have an insurance deductible for:: Pays to fix your automobile after damage brought on by a chauffeur without insurance coverage or without enough coverage (business insurance).: Pays your medical expenses when you have actually been hurt in an accident.: Covers the expenses of some mechanical fixings, a lot like a warranty.

Some Of What Is A Car Insurance Deductible? – Forbes Advisor

Whether you pay a deductible after an event depends on your insurance coverage, who is at mistake, your insurance company, and your state's legislations. For instance, in The golden state, you might certify for an insurance deductible waiver on your accident insurance coverage, which means your insurer will certainly pay the deductible if a without insurance vehicle driver strikes you.

Exactly how Does a Deductible Work? Imagine a tree branch drops on your car as well as creates damages. You submit an insurance claim on your detailed protection and the repair work store approximates it will cost $1,000 to fix. What you'll pay depends on your deductible: $250 $250 $750 $500 $500 $500 $1,000 $1,000 $0 If the price of repairing the damage coincides or virtually the like your deductible, you might select not to submit an insurance claim given that you would certainly shed any claim-free discount rate - cheap.

When Do You Pay a Deductible? You'll normally pay your deductible straight to the auto service center after they complete the repairs. The insurer will subtract your section from the total they send to the repair service shop. In the scenario over, with a $500 insurance deductible, the insurance policy business would certainly pay the vehicle repair store $500, and also you 'd be expected to pay the various other $500.

Should you try to conserve cash by choosing a greater insurance deductible or really feel more protected by going with a reduced one? To choose the appropriate insurance deductible for you, you'll need to consider your driving background, your emergency situation fund, as well as the prices of various deductibles, along with several various other aspects.

Some Ideas on Who Pays The Deductible In A Car Accident? - Anidjar & Levine You Should Know

Trick Takeaways Your insurance deductible is the portion of costs you'll pay for a covered claim. Weigh your auto's worth, your emergency situation fund, as well as the costs of insurance coverage when selecting a deductible. Choosing a greater insurance deductible may assist you conserve money on premiums, yet this implies you'll have to pay even more out of pocket after an accident.

In some states, you might also have an insurance deductible for:: Pays to repair your car after damages brought on by a chauffeur without insurance policy or without enough coverage.: Pays your medical expenses when you've been harmed in an accident.: Covers the expenses of some mechanical repair work, much like a warranty.

Whether you pay a deductible after an occasion relies on your protection, who is at fault, your insurance policy company, and also your state's laws. As an example, in The golden state, you can get an insurance deductible waiver on your crash protection, which means your insurance provider will pay the insurance deductible if a without insurance motorist strikes you.

affordable auto insurance cheap car trucks dui

affordable auto insurance cheap car trucks dui

How Does an Insurance deductible Work? Imagine a tree branch falls on your automobile and also creates damage. You file an insurance claim on your extensive insurance coverage as well as the service center estimates it will cost $1,000 to fix. What you'll pay depends on your insurance deductible: $250 $250 $750 $500 $500 $500 $1,000 $1,000 $0 If the price of repairing the damages is the very same or almost the very same as your insurance deductible, you may pick not to sue considering that you 'd lose any type of claim-free price cut.

Indicators on Auto Insurance Claims Faq - Amica You Need To Know

When Do You Pay a Deductible? You'll commonly pay your insurance deductible straight to the vehicle service center after they finish the repairs. The insurance company will certainly subtract your section from the overall they send to the fixing shop. In the circumstance over, with a $500 deductible, the insurance coverage business would certainly pay the auto repair store $500, as well as you would certainly be anticipated to pay the various other $500.

Should you attempt to conserve money by selecting a greater deductible or feel more safe and secure by going with a lower one? To select the right insurance deductible for you, you'll require to consider your driving background, your emergency fund, as well as the costs of various deductibles, along with numerous various other factors.

Secret Takeaways Your insurance deductible is the section of costs you'll spend for a protected insurance claim. Weigh Click here to find out more your car's worth, your emergency situation fund, and the prices of insurance coverage when choosing a deductible. Choosing a higher deductible might help you save money on costs, but this implies you'll need to pay more expense after an accident.

In some states, you may likewise have an insurance deductible for:: Pays to fix your car after damages caused by a vehicle driver without insurance or without sufficient coverage (insurance).: Pays your medical bills when you've been harmed in an accident.: Covers the prices of some mechanical repair services, just like a service warranty.

The Of How To Choose Your Auto Insurance Deductibles - Rates.ca

Whether you pay a deductible after an occasion depends on your insurance coverage, who is at fault, your insurance coverage company, and also your state's laws. For instance, in The golden state, you can get approved for a deductible waiver on your accident insurance coverage, which suggests your insurance firm will certainly pay the insurance deductible if an uninsured motorist strikes you.

Just how Does a Deductible Job? Think of a tree branch drops on your car and also triggers damage. You sue on your thorough insurance coverage as well as the repair service shop approximates it will certainly cost $1,000 to repair. What you'll pay relies on your insurance deductible: $250 $250 $750 $500 $500 $500 $1,000 $1,000 $0 If the price of repairing the damage coincides or almost the like your deductible, you might pick not to submit a claim considering that you 'd lose any kind of claim-free discount rate.

When Do You Pay a Deductible? You'll normally pay your insurance deductible straight to the vehicle repair service shop after they finish the repair services. The insurance firm will certainly deduct your part from the total amount they send to the fixing shop. In the circumstance over, with a $500 insurance deductible, the insurance policy business would pay the automobile repair service store $500, and also you would certainly be anticipated to pay the various other $500.